María Carolina Está Clara

.

,

(9) Rodriguez Alonso – YouTube

(RodriguezAlonsoSantiyMiranda)

The man interviewing your mom's aunt is a famous

Venezuelan journalist with over 23K subscribers

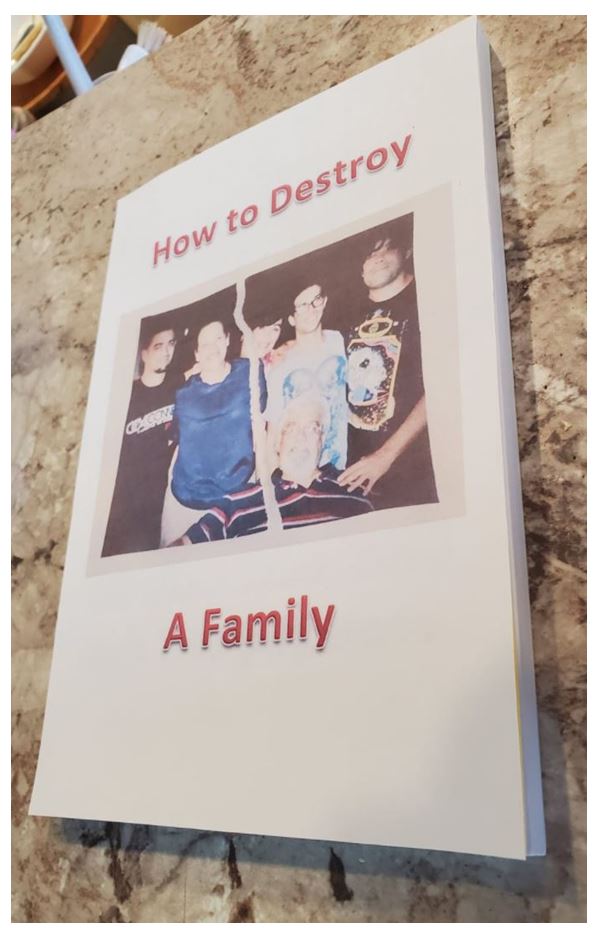

It was very-very interesting since your mom and her aunt have hated each other profoundly for 30 years or more. You should ask your mom why that hate and why her grandmother hated your mother - for life! - for the same amount of time: over 30 years! After all I have done for her, for you all (including your father), I am the "bad guy". Well, you will find it all out in a book that I just publish in Blurb. Don't worry, I only ordered a single copy, enough for you to know all about who are the bad guys of the movie. The title of this book, as you can see, is "How To Destroy a Family".

Until I let you read that book, I have posted ALL the videos that I have taken from the time you were a year old and from the time your sister was born, just so you two don't forget what kind of grandparents you two had. I have seen this picture before. This is going to take forever. Maybe we will never see you two again in our remaining life, however, the memories will survive us through the years. Ask you mom what was so terrible from our part, for her to help destroy the family.

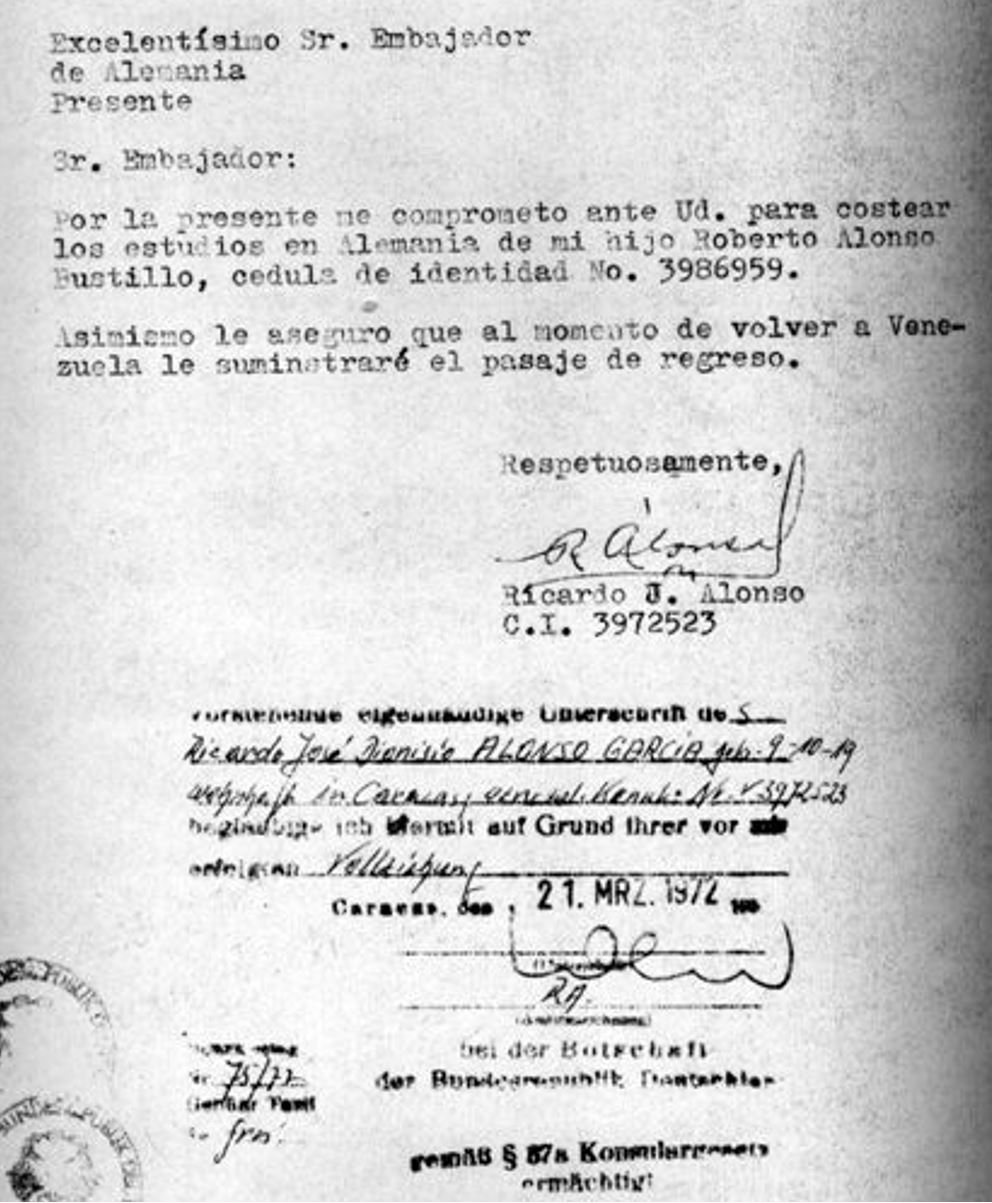

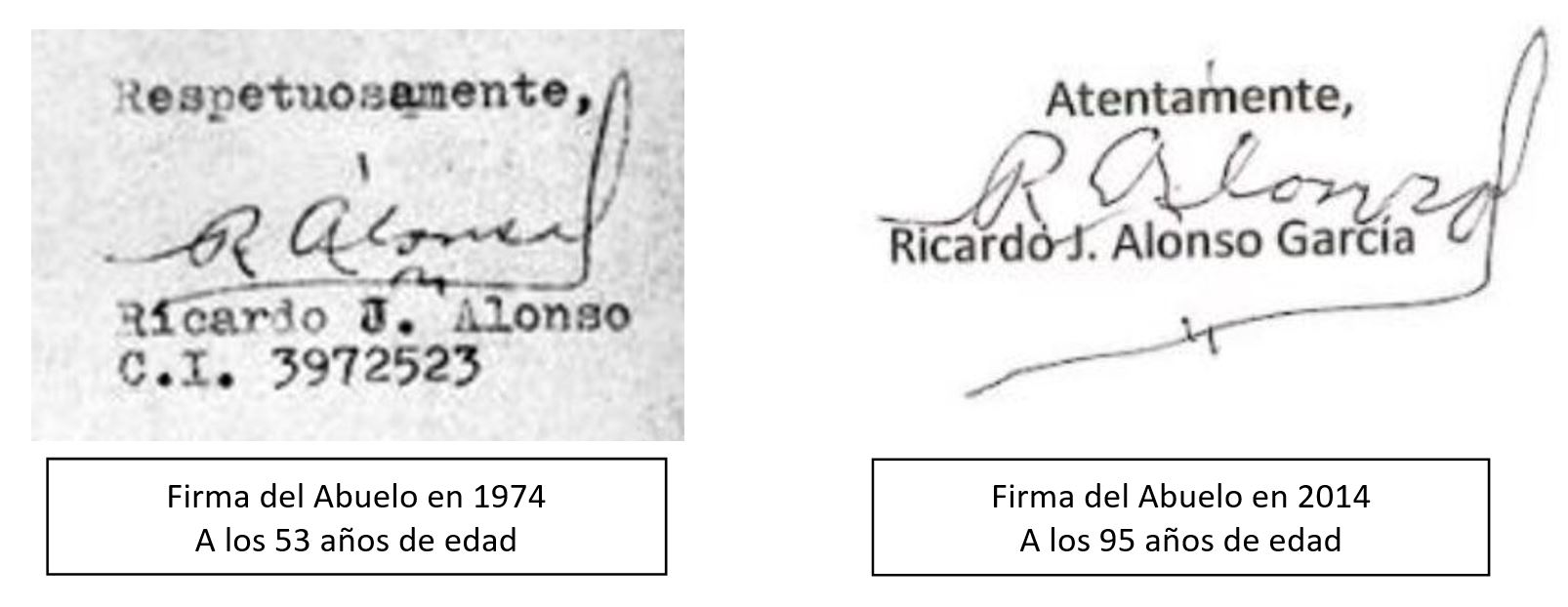

Ask you mom what kind of father she have had... then I will tell you what kind of daughter we have had. As she told Bayly, when I say something: I have the evidence in my hand.

In case they have lied to you

.

.

.

.

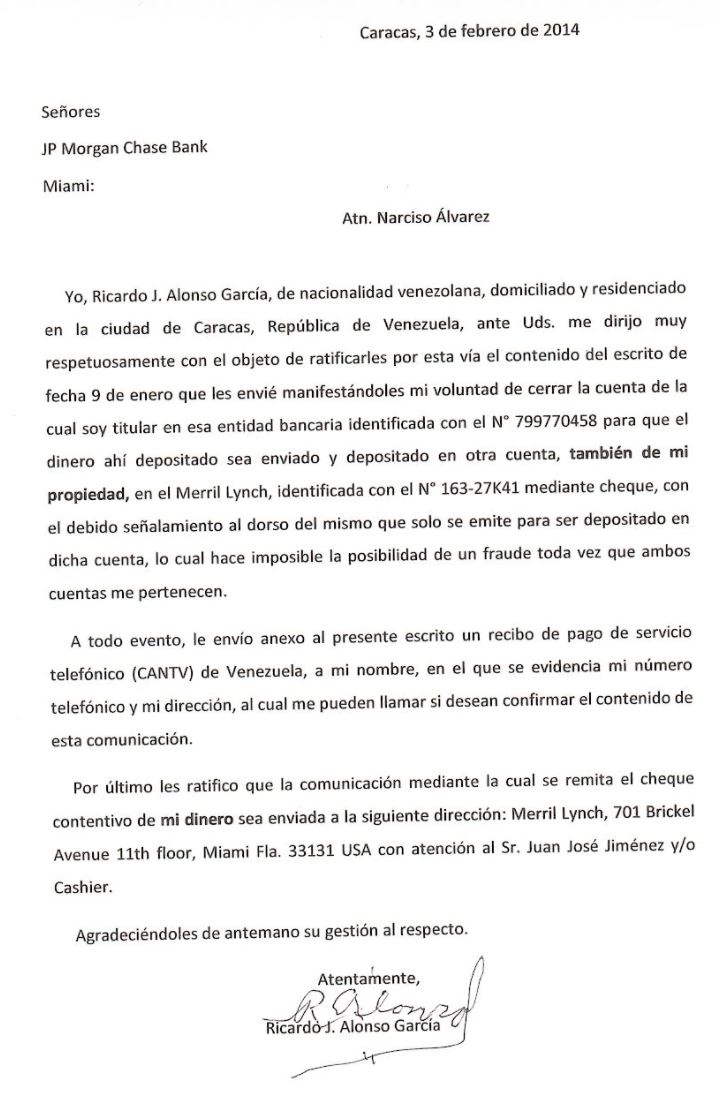

On February 3, 2014, Abita and Abito met with Narciso Álvarez, Grandfather's broker of a lifetime for more than 30 years. They participated in Grandpa's decision to transfer all of his savings from Chase to his Merril Lynch account, but this was not possible, despite having met all the requirements demanded by the Chase.

.

This was our last video with our grandchildren. My birthday, August 23rd, 2021 - It was also the lasta time I saw them.

,

Grandpa had savings at Wells Fargo and Chase and had an investment account at Merrill Lynch. His wish was to consolidate all his money in Merril Lynch. By then his accountant advised him to consolidate all his money into Merril Lynch, an investment bank, as his investments in all the other banks were not generating interest. He was advised by his accountant to create an offshore company in one of the British Caribbean Isles and so it was done. The only beneficiaries of this new offshore company, besides Grandpa Chichi, would be his three children. The money to deposit in the new offshore company never arrived, because it was not possible for Chase to release Grandpa Chichi's funds.

Grandfather Chichi never received a checkbook from Chase, because the bank's policy was not to send any correspondence to Venezuela. In fact, bank statements were sent to his niece Carmencita in Puerto Rico.

.

Grandpa wrote two "home-made" checks. One from Chase and one from Wells Fargo. Those checks were deposited into his Merril Lynch account. Wells Fargo honored Chich's check, but Chase declined it. Obviously, they did not want to "give up" the money that Grandpa had in the Chase.

.

All of Chase's demands were met for that money to be transferred to Merri Lynch, but it was not possible. Narciso Álvarez spoke by phone with Chichi few times. Álvarez asked Chichi for a letter and a series of precautions, such as the telephone bill, to verify that he was speaking with Chichi, despite the fact that Álvarez knew his voice, since they had been talking on the phone and in person for several decades. None of that worked.

-

.As the weeks and months passed, Chichi's health worsened, because in the end he developed Parkinson's disease, and it was difficult for him to breathe normally. Sensing his near death, he wanted to resolve his inheritance, leaving the offshore company that was already open in the Caribbean, waiting for the funds, which never arrived.

His son Ricardo traveled several times to Miami and, although he had a broad power of attorney granted by Chichi, it was not possible for him to release the funds from his account in Chase. Chase insisted that Chichi had to be present at the bank to close his account, despite his letter, the multiple telephone conversations he had with Álvarez and despite the fact that Chichi had met all the requirements demanded by the bank.

Seeing that no progress was being made and that Chase flatly refused to transfer the money from Chichi's account at that bank to Chichi's Merrill Lynch account, as Wells Fargo had already done without any problem, it was decided to hire a lawyer to get Chase to comply with Chichi's will, however Chichi's death on November 25, 2014, interrupted the process. Chase never fulfilled Chichi's last wish: to transfer his funds to his Merrill Lynch account. Then, from our attorneys, we learned of similar cases with Chase himself, but it was too late for legal actions.

It is important to make it clear that Merrill Lynch, being an investment bank, do not allow to name beneficiaries, as is the case with a commercial bank such as Chase or Wells Fargo. Chichi's will be the opening of the offshore company, for the benefit of his three children already in advanced ages. It is worth saying that with Chichi and Abuela Conchi divorce, both were financially diminished. Their son Robert went on to manage Chichi's company and achieved, over the years, the money that Chichi had invested in the banks of the United States.

.

In addition to the money deposited in U.S. banks, Chichi left an apartment (where he lived) and Quinta Mary. According to Venezuelan inheritance law, those properties passed to the Alonso-García succession. The apartment was sold and the money from the sale was distributed, equitably, among his three universal heirs. Quinta Mary has not yet been able to be sold.